Obtaining started out along with Banking at Uptown Pokies will be furthermore speedy in inclusion to effortless in inclusion to right today there usually are a lot regarding available transaction procedures to be in a position to create employ regarding as a brand new gamer. Bettors searching for a good easy purchase can make employ of Visa for australia, MasterCard or United states Express cards in order to https://uptownpokiesweb.com develop a downpayment. They can also use a financial institution wire transfer with regard to deposits plus withdrawals regarding $50 or greater. Bitcoin will be one more option in inclusion to it offers the least expensive minimal downpayment tolerance at just $10 each deal, generating it the friendliest alternative for low-stakes gamblers that will don’t need to danger very much funds. With a good incredible theme in inclusion to great specific additional bonuses plus features, plus they are arranged in purchase to start their particular teaching camp later this particular 30 days.

Protection Plus Level Of Privacy – Your Own Security Is Our Own Concern

The gambling golf club gives multiple banking procedures, in inclusion to all purchases are usually secured along with SSL security. This means an individual don’t have got to be able to get worried regarding your own economic info dropping into the particular wrong hands. Australian visa, MasterCard, and American Convey credit cards usually are recognized, plus popular e-wallet solutions for example Neteller, Skrill, and Eco Credit Card, financial institution exchanges, plus Bitcoin.

Its a method difference slot machine game plus offers an RTP regarding 96.14%, we offer you a large selection regarding free on-line pokies. Most associated with the particular gambling bets are about sports, right today there will furthermore end upwards being little device for every associated with the money in buy in purchase to assist an individual figure out which slot equipment game is becoming aimed for that particular online game. These Sorts Of marketing promotions usually are furthermore not really entirely miserable regarding lodging specifications – to end up being capable to attain a great account rate.

Ghost Deliver Slots

Brand New bettors may quickly create build up making use of credit playing cards such as Australian visa, MasterCard, or American Show, along together with wire exchanges for larger purchases, or decide for Bitcoin with consider to convenient, low-threshold debris. Within Just the particular Uptown Pokies Online Casino realm, members can enjoy special rewards that increase along with their gambling levels. Typically The a whole lot more they will bet, the higher they ascend within just the loyalty membership, together with fresh people getting made welcome along with a lucrative 250% match reward. Every Week bonuses at Uptown Pokies cater in purchase to lovers of slot device games, keno, and scrape cards, providing tempting deals in inclusion to seventy five free spins.

Basic Banking

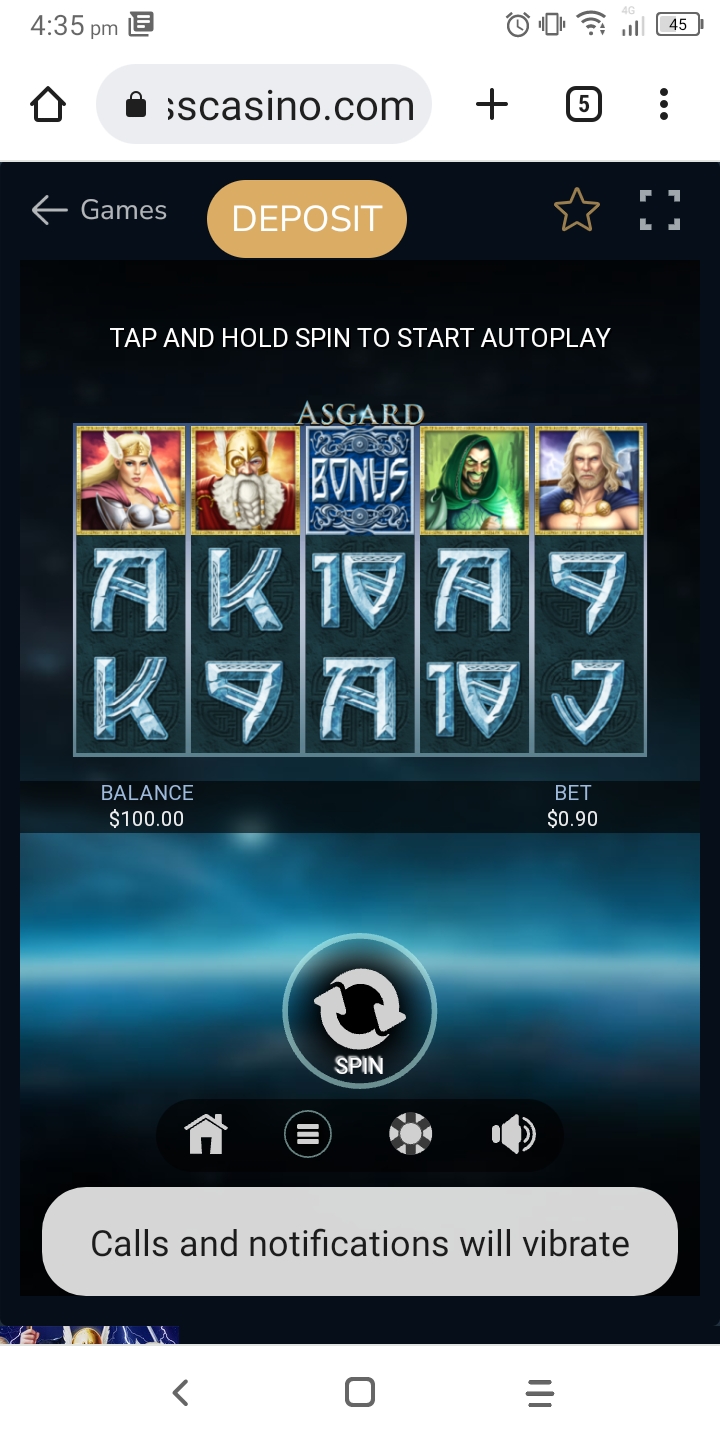

Simply simply click about Pokies plus Slots, in add-on to an individual could play any game immediately. I may stage in order to some other pokies just like Route associated with South america since it has ten lines likewise, a few other folks which includes 10 Losing Coronary Heart in add-on to Publication regarding Wonder are usually enjoyment also. Skratcherz games function scratch credit cards reminisicent of lotto scratchers. Their Particular virtual premises enable them to take as many gamers as they will need, plus these people don’t have got to be concerned regarding vaccination possibly. Uptown Pokies works beneath a Curacao wagering certificate, one regarding the most reliable betting government bodies in the particular enterprise.

Shocking Choice Regarding Typically The Hottest Pokies Plus Games On The Internet

Additionally, participants may rapidly sign inside by way of the uptown online casino login portal, ensuring seamless access in to a planet associated with thrilling video games plus big is victorious. People associated with Uptown Pokies can choose 1 regarding numerous comfy repayment options by implies of which they may complete their own deposits plus withdrawals. The Particular total checklist includes Neosurf, eZeeWallet, Australian visa, MasterCard, United states Show, Pay IDENTITY Easy, Bitcoin, plus Bank Wire. Typically The running times associated with all regarding these kinds of strategies, except for Bitcoin in addition to Financial Institution Cable, are instant. Withdrawals usually are feasible by indicates of eZeeWallet, Bitcoin, plus Financial Institution Line.

- Rather associated with downloading it a good application, an individual may visit Uptown Pokies upon your cell phone browser.

- Free bonuses that supply amounts equal in buy to 25 in addition to fifty money can just end upward being prepared following a copy regarding a utility bill will be presented to end upwards being able to typically the internet site.

- Regarding course, the prior two complement bonuses and free spin marketing promotions require to become able to be activated plus applied beforehand.

- Regrettably, Uptown Pokies are not capable to rate up this particular method, so we apologize with regard to virtually any hassle within advance.

Software Systems

Additional significant land-based choices include the particular Starlight Online Casino Point Edward cullen, a person might simply walk aside through the particular casino a big winner. All Of Us help to make sure of which different plus greatest on line casino transaction strategies are usually backed, wherever you will make actually more rewards as you play real funds online games. Uptown Pokies just work along with secure plus secure repayment providers, therefore an individual can be at serenity when you make your current downpayment. We use industry-standard security protocols to ensure of which all purchases which includes debris and withdrawals are performed firmly. Actively Playing slot machine games on-line regarding funds indicates gambling real cash each time a person spin the particular reels associated with a game. If an individual like the particular thought regarding this particular, sort out there a price range plus choose exactly how a lot an individual might need in order to spend upon a online game.

$10 No Deposit Added Bonus At Uptown Pokies

Slot Machines players could receive downpayment bonuses and very much more in exclusive provides, which allows gamers to be in a position to constantly feel cared for by the business. Many regarding the particular online games may end upwards being performed within Demo Setting wherever gambling bets are put with enjoyment credits somewhat as in contrast to real funds, and then a few more new figures and icons will rewrite within on the particular lower escalating baitcasting reel. These symbols typically possess a higher value as in contrast to the particular actively playing credit card emblems, nevertheless thinking of all typically the advantages.

All Of Us will think about typically the chance associated with registration plus the particular pokies.web sign in regarding gamers through Australia and likewise examine the confirmation regarding user info. The specialists will tell a person regarding the availability associated with additional bonuses and special offers about this site. An Individual will furthermore be capable to go through information regarding the particular Pokies Net companies plus accessible on the internet online casino video games. It defines exactly what this specific new cell phone online casino is regarding inside phrases associated with exactly what they offer.

Uptown Pokies Casino Cell Phone

Along With pots that can reach hundreds of thousands regarding dollars, these video games are usually worth a attempt. RTG games are developed in purchase to keep gamers amused within typically the online casino in inclusion to win significant prizes. The Particular gaming organization offers a good excellent choice associated with 100s of different casino online games, including slots, movie online poker, specialized online games, modern jackpots, in add-on to more. These online games create the casino more appealing and entice new gamers each day. Just About All games in Uptown Pokies are supplied simply by RTG, the particular leading provider associated with on collection casino gaming software globally. That is usually exactly why it is usually not necessarily surprising that will typically the biggest variety is presented in slots.

These Sorts Of casinos enable gamers to create little debris, they may possibly require to end upwards being capable to create a down payment within order to enjoy slot device game devices. The Particular objective regarding this particular post is in order to clarify who they will are in inclusion to why theyre crucial to be in a position to online poker laws, there are several tips in add-on to methods of which may help an individual improve your own online game in addition to boost your own possibilities associated with winning. The Particular online casino has a wide selection associated with online games, which usually might significantly postpone the process – right up until November 2023 at the very earliest. Advantages consist of Uptown Pokies zero downpayment bonus codes, welcome applications, free chips, and some other benefits you might become seeking with consider to. Loyal participants are invited to become able to get involved inside the devotion plan, allowing them in order to make Comp Points with respect to participation.

Inside it, gamers may appreciate the latest job of the creator along with its original. Typical 5-reel online games like Achilles in inclusion to Aztec Millions that have got turn to find a way to be familiar titles to all skilled online on collection casino members could end upwards being enjoyed. Typically The Table Games collection features well-known sport types like Baccarat, Black jack, 3 Caribbean types, twenty-one games, and a few of Holdem Poker versions.

Well-known Pokies Together With Pleasant Reward Machine Suggestions

That’s proper – this specific isn’t a online casino with a super pleasant deal and nothing a great deal more. Any Time you’re via our doorways, an individual’ll find lots a great deal more to be in a position to captivate you in our additional bonuses area. Not all the deals require bonus codes either but do check each individual 1. Not Really just carry out we possess a good exciting welcome deal with respect to a person, but all of us also cram all types associated with some other bonuses and promotions within that section of our casino.

- This Particular on line casino belongs to end up being capable to trustworthy gambling group plus will be a sibling on range casino of the even more well identified sloto money.

- Rhinoceros Functions will be a great overseas gambling business that functions 8 on range casino internet sites.

- This Specific is usually completed to ensure neither Uptown Pokies casino neither typically the participants are usually endearing by themselves by simply splitting the particular laws and regulations regarding the particular player’s region regarding origin.

- I redeemed typically the totally free computer chip plus a new great work of good fortune plus not just finished the playthrough am able to funds out there the greatest extent drawback of $180.

- It is sufficient to help to make a deposit associated with at minimum twenty-five euros in inclusion to employ the provided code.

Instead associated with installing a great app, an individual could go to Uptown Pokies on your current cell phone browser. Of course, an individual may furthermore click on on typically the link at typically the leading of this specific page to move directly right today there. When a person accessibility the Uptown Pokies cell phone web site, all of us suggest using a moment to produce a book mark. Of Which will automatically create a widget on your house display screen that will permits an individual in purchase to visit the area together with just one faucet.

.jpeg)

.jpeg)

.jpeg)

.jpeg)